The old joke goes, “there are two things you can count on: death and taxes”. It seems that rising insurance premiums can be included. Why is that? And is there anything you can do about it?

There’s 2 main reasons why premiums go up:

- The rising cost of claims

- Low interest rates

Where does the money go?

When you pay your premiums, where does it all go? Does the insurance company gouge you and keep it all to themselves?

For every $100 you pay in premiums, insurance companies keep about $8. That 8 bucks is the company’s profit margin.

According to the Insurance Bureau of Canada’s annual report, $56 of every $100 you pay goes to claims. Another $35 goes to taxes and expenses:

Are expenses too high?

You might think, “Wow – 21% for expenses? That seems really high!”

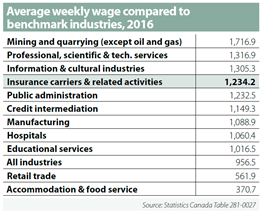

The insurance industry employs a lot of people and wages make up a big part of that expense. The insurance industry pays about the same as the government sector:

Source: IBC Annual Report 2017

For the most part, workers in the insurance industry are not getting paid like royalty or professional sports players.

Auto Claims: More of them – and more costly

In 2015, there were 384,656 auto claims in Canada – one every 82 seconds. By the time you finish reading this post, there were 5 car accidents!

In that year, the average claim cost $10,043 and the average premium was $987. From 2011 to 2015, Liability claims increased 11.2%. As a result, Liability premiums increased 14.4%.

Auto insurance premiums are highly regulated by the government, and insurance companies must apply for rate increases. In 2012, an Alberta court decision weakened the minor injury, or “soft tissue” payment cap. When that happened, the cost to settle bodily injury claims rose 51%!

Catastrophic Claims

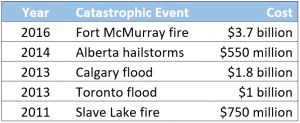

Insurance companies pay out a lot of small claims for fender-benders, kitchen fires and sewers backing up. It’s very hard to account for rare and catastrophic claims. Recent ones include:

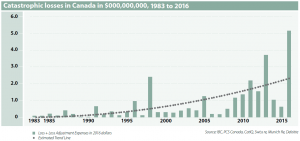

This chart shows the trend of catastrophic losses in Canada – and its not a good one:

Because they are rare and nearly impossible to predict, insurance companies can’t plan for large catastrophic claims. When they happen, companies need to raise premiums to recover losses.

Interest rates play a big factor

Insurance companies take your premium and save a chunk of it for future claims. This is called a reserve. Almost 70% of insurance companies invest those reserves in bonds. As interest rates fall, so does the profit on those reserves.

Throughout the 1980’s and 1990’s interest rates fell a lot. As those high-yielding bonds matured, insurance companies had to re-invest at low rates. Think of this way: insurance companies count on making money on the reserves so they can pay out claims. If profits on those reserves fall, then they need to get more premiums!

Can you self-insure?

You’ve seen your insurance premiums rise every year and maybe you’ve never had a claim. You might think to yourself, “Why bother paying for insurance I’ve never used? I should insure myself!”

In Alberta, you must carry Liability insurance on your vehicle. Other than that, you are not legally required to have insurance on anything. If you have a mortgage on your home, the lender will probably ask you to have insurance – it’s their money in your home, after all.

Large companies will often self-insure parts of their business or equipment. They have deep pockets and can afford a loss. If you have deep pockets too, then self-insuring part of your stuff is an option.

What can you do about it?

To some degree, rising insurance premiums have become a part of our life. The idea behind insurance is that we all share in the risk with small losses that are known – the premium. We protect ourselves against the large losses we cannot pay for ourselves.

However, there’s lots of things you can do to lower your premiums or keep them low! Check out our blog post on 9 ways to save money on home insurance and 9 ways to save money on your car insurance