COVID-19 Update

Dear friends and clients,

We are living in unprecedented times, but we are facing these challenges and uncertainties together. As a business, the Caliber Insurance Brokers team is working to do everything we can to continue to be there for you, providing the high level of service you are accustomed to.

For those of you who currently hold insurance with us, are awaiting a quotation, or are about to get your new policy, we are still here for you and we are taking all the necessary precautions in order to fulfill these duties safely.

With the information we have regarding COVID-19, we are taking the necessary and appropriate steps to keep everyone's health and safety a top priority. One of those steps is to limit contact, as such we have shortened our hours to 10-4, Monday-Friday, and our offices are currently closed to the public as we do our part to encourage social distancing by working 100% remotely.

Through email, phone, or video, we can provide you with updates on current market conditions, rates, and set up action plans to ensure you are receiving all the services you need. Our team has ensured that each one of us has fully equipped home-offices set up to continue serving you, our valued clients, at full capacity.

The health of our clients, our team, and the general public are our highest priority, and we urge you to join us in focusing on the health and safety of our community during these trying times. As per the Government of Canada:

Together, we can slow the spread of COVID-19 by making a conscious effort to keep a physical distance between each other. Social distancing is proven to be one of the most effective ways to reduce the spread of illness during an outbreak.

This means making changes in your everyday routines to minimize close contact with others, including:

- avoiding crowded places and non-essential gatherings

- avoiding common greetings, such as handshakes

- limiting contact with people at higher risk like older adults and those in poor health

- keeping a distance of at least 2 arms-length (approximately 2 metres) from others

Proper hygiene can help reduce the risk of infection or spreading infection to others:

- wash your hands often with soap and water for at least 20 seconds, especially after using the washroom and when preparing food

- use alcohol-based hand sanitizer if soap and water are not available

- when coughing or sneezing:

- cough or sneeze into a tissue or the bend of your arm, not your hand

- dispose of any tissues you have used as soon as possible in a lined waste basket and wash your hands afterwards

- avoid touching your eyes, nose, or mouth with unwashed hands

- clean the following high-touch surfaces frequently with regular household cleaners or diluted bleach (1 part bleach to 9 parts water):

- toys

- toilets

- phones

- electronics

- door handles

- bedside tables

- television remotes

If you are a healthy individual, the use of a mask is not recommended for preventing the spread of COVID-19.

Wearing a mask when you are not ill may give a false sense of security. There is a potential risk of infection with improper mask use and disposal. They also need to be changed frequently.

However, your health care provider may recommend you wear a mask if you are experiencing symptoms of COVID-19 while you are seeking or waiting for care. In this instance, masks are an appropriate part of infection prevention and control measures. The mask acts as a barrier and helps stop the tiny droplets from spreading you when you cough or sneeze.

Most importantly, stay positive and continue to support each other. We can and we will get through this together, growing closer and stronger as a community.

The Caliber Insurance Brokers team is still here to answer any questions you may have, so please don't hesitate to reach out, even if it's just to chat.

You can do this. Take care and stay safe.

-The Caliber Insurance Brokers team

What's the Difference Between an Insurance Broker and a Direct Writer?

You can get home and auto insurance in Alberta from 2 places:

- An insurance broker

- Directly from the insurance company - referred to as a direct writer

Is one better than the other? Is it always cheaper to deal directly with the insurance company?

It depends on your situation. If your situation is very simple and easy, then a direct writer may be cheaper. If it's more complex, then dealing with a good broker may save you money.

Direct Writers

When you have to call an insurance company directly, you are dealing with a direct writer. They tend to do a lot of advertising and run large call centers. Some direct writers in Alberta include:

- TD Insurance

- Sonnet

- Belair Direct

- Johnson Insurance

- AMA

- Although they have local representatives, Co-operators, State Farm and Allstate are also direct writers

Naturally, direct writers will only sell you their own insurance product. If you're looking for 3 quote options, you'll be calling 3 direct writers.

Brokers

Although there are some very large brokers in Alberta, the majority are independently owned offices. When you work with an insurance broker, they'll deal with several companies on your behalf. You talk to your broker - and then your broker talks to the insurance companies.

Brokers deal with carriers like:

- Intact

- Aviva

- Portage Mutual

- Economical

- Wawanesa

- Peace Hills

When it comes to insurance, there is no single best solution. Below are advantages and disadvantages of dealing with a direct writer or a broker. Even though we're brokers, we think this list will help you decide what's best for your needs.

Direct Writers: Advantages

Extended call hours

Most direct writers take calls between 8AM and 8PM on the weekdays and 9AM to 5PM on Saturdays. Some are even available on Sundays!

Fast quotes

Direct writers let you get a quote on your smart phone in a few minutes, which is handy when you're shopping around.

Low premiums

Typically, direct writers have competitive rates - when your situation is simple.

Direct Writers: Disadvantages

You get a different agent every time

You're calling a call center. That means you don't get an assigned account manager. You'll be explaining your situation every time you call. If you want to be on a first-name basis with your broker, don't call a direct writer!

They usually don't deal with complex situations

Did you just move to Alberta from another province or country? Did the direct writer take the time to explain how to get credit for your driving history? You can click here to read the blog post on that topic.

They typically insure "easy" stuff

Generally, direct writers won't insure standalone rented dwellings, which are rental properties without your home insurance attached. They also tend to stay away from out-of-province rentals, multiple rented dwellings, vacant dwellings or rentals with several tenants, which are considered rooming houses.

Nothing is confidential

Did you have some damage to your home and not sure if you should put in a claim? If you ask a direct writer, they note your file - even if you don't start a claim!

In life, there are trade offs. You might save some money dealing directly with an insurance company, but you also don't have anyone looking out for your best interests. From personal experience, there is a chance something gets missed or you won't be given any solutions.

Insurance Brokers: Advantages

We work for you, not the insurance company

Insurance companies pay brokers a commission each year on the premium you pay. The commission is the same rate from each company, so we are not paid more to place you with one company over another. Our priority is to keep you as a client, rather than keeping you with a certain company.

Access to several insurance companies

Did one company say 'no' to you? No problem! We simply go to another company. Did your renewal premiums go up? No problem! We shop our other carriers to try and find you a lower rate. Different insurance companies are better for your needs. Depending on your situation, one company may be more competitive than the others.

Conversations are confidential

If you backed your car into your tree, you may not want to put in a claim - you might be better off paying for those repairs yourself. As a broker, we can offer advice on when it makes sense to put in a claim - and when it doesn't. Although we are looking out for your best interests, we do need to disclose important information to the insurance company that affects rates. If you have speeding tickets or suspensions, we must disclose that information.

We're not on a timer

When you call us with questions or need help, we take as long as you need. If we have a 27-minute conversation, nobody is telling us to get off the call. We make sure to ask all of the questions and cover everything that needs to be covered! Many times an insurance broker can get you a lower price when they get better information from you.

We deal with insurance companies all day long

If your situation is tricky or complex, we know how to present it to the insurance company. It's our business to know what they look for. We form a good relationship with our carriers and we know what they will do - and won't do. They get to know us and we establish ourselves as competent, responsible brokers.

Deal with the same person

Once you find a broker you like, you can always deal with them! You get to know them - and they get to know you. If you like the idea of dealing with the same person all the time, then an insurance broker is right for you.

You can see us face-to-face

Although we do most of our work over the phone and by email, clients stop in to see us all the time! Some people still value that face-to-face interaction.

Insurance Brokers: Disadvantages

No contact at renewal

Each year, your policy renews and premiums usually go up. Sometimes, the increase is only a few bucks and other times, it's pretty substantial. If you don't hear from your broker, you start to wonder, "Am I getting the best price possible?" Each year, we remarket your policy. That means we compare your renewal to our other carriers for the best price. That doesn't mean we'll switch you every year - but we want you to know that we're looking out for you!

Are they selling me coverage I don't need?

We tell you what's available and let you decide if you need it or not. You might think that coverage for Identity Theft or Flood is a great idea or a rip-off. We'll make suggestions on what's beneficial for you (like Accident Forgiveness) and what's open to debate (like glass coverage)

Limited extended hours

Do you like to deal with your insurance on Sunday at 7PM? We try to keep office hours from Monday to Friday and we're available over the lunch hour.

What's Best for You?

We're very busy helping clients and we're getting a lot of new business. A lot of people still choose to deal with a broker! We see firsthand that the "super cheap" direct writers can't always solve your problem. Whether you value that personal service or you have a lot of moving parts, we'd be happy to provide a quote anytime and offer some friendly advice.

Water Damage: Will Your Policy Leave You High and Dry?

When you think of a home insurance claim, you probably think of fire or theft. While those are dramatic and vivid, its actually water damage that make up half of claims in Alberta.

This post talks about the 5 types of water coverage available:

- Water Escape

- Sewer Back Up

- Overland (Flood)

- Water & Service Lines

- Ground Water

Water Escape

Water escape includes damage from a hot water tank, dishwasher, washing machine or burst pipe. Frozen pipes are a big problem in the winter. It could also include water that gets in from a hail or wind storm – if a tree lands on your house and makes hole, rain can get in.

This coverage is usually part of the main policy.

Sewer Back Up

If you live in the city or an area with sewer lines, these can get filled with water. Too much water in the sewer system can back up into your basement. It’s pretty gross and can be expensive to deal with!

This coverage is optional – make sure you have it! Edmonton sees a lot of sewer back up claims. Even if you don’t have a finished basement, the cost for cleanup and a new furnace can run into the tens of thousands.

We see policies with only $20,000 or $30,000 of coverage. If you have a finished basement, that’s not nearly enough. Ask for a quote on the maximum coverage available.

Overland Water (Flood)

Before the 2013 Calgary flood, no insurance company in Canada covered this damage. Overland water provides coverage if water gets into your home through the front door or the basement window.

Some insurance companies include it with sewer back up and others offer it as an extra. Premiums are about $75 a year. even if you don’t live by a river or lake, we can get flash rainstorms that can cause flooding!

Water & Service Lines

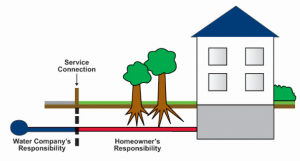

You might see a flyer in your mailbox from the local utility company for this coverage. The water and sewer lines that run between your home and the property line are your responsibility in case they fail, get crushed by a tree root or collapse.

Although not as serious as a sewer back up, it can be a costly hassle. Our insurance companies offer this coverage for about $30 a year. This is a good idea for older homes built in the 1970s or earlier – those lines are more likely to see damage.

Ground Water

Sometimes the soil around your home gets saturated enough for water to actually push through your basement walls. This is considered ground water. The water didn’t come up through the sewer or a window or door.

Some areas around Edmonton collect a lot of water during the Spring melt and that ground water can get into your basement. You’ll notice that your carpet or walls are wet.

When it comes to water coverage, not all insurance policies are the same! We can review your policy to make sure you’re covered.

8 Ways to Lower Your Auto Insurance Premiums

Auto insurance premiums seem to go up every year. We wrote a post on why they go up. But can you do anything about it?

You sure can! Here are 8 things you can do to keep your premiums as low as possible:

1. Intact's MyDriving Discount

Are you a young driver under age 25 or a new driver? Intact recently launched the MyDriving Discount which tracks your driving patterns with their new app. You can click here to learn more. Depending on your coverage, you can get a 10% discount when you sign up. After that, the discount can be as high as 25%.

2. Go with a higher deductible

When you have a claim, the deductible is the amount that you pay. If you have a $500 deductible and your claim is for $1,300, then you pay the first $500 and the insurance company pays the other $800.

A higher deductible means you won't put in small claims. And those small claims really add up for the insurance company! Ask your insurance broker how much you'd save with a higher deductible. It might be worth it!

3. Not using your vehicle for a few months? You can 'park' it

If you plan on not driving your vehicle for a few months, your broker can remove the Liability and Collision coverage on the vehicle. You keep Comprehensive coverage, which covers the vehicle from fire, theft, hail or vandalism. This can save you a lot of money! Keep in mind: You can't 'park' a vehicle that's on public property or if its financed.

4. Watch out for the extras

Aside from Liability, Collision and Comprehensive, you can get extra features on your policy. Some of those features (like Accident Forgiveness) can be a really good idea. However, if you never plan on renting a car or driving someone else's car, you may not need SEF27 Extension to Non-Owned vehicles. Take a moment to ask your broker what coverages you have. You may be paying for something you don't want!

5. Pay annually for your insurance

When you have monthly insurance payments, you are paying interest. Although its not crazy, most insurance companies charge 3% or 4% interest for monthly payments. If you can pay once a year, you'll avoid that charge.

6. Make sure you have the best rating

Did you start driving outside Alberta? Check out our post on how out-of-province drivers can save money when they move to Alberta. Some insurance companies give you a better rate when you're married and for certain occupations.

7. Credit consent

Insurance companies now take your credit score into account when quoting. Make sure you give your broker consent to let the insurance company pull your credit history. It's a "soft" credit check that won't negatively affect your score. It can save you a few hundred bucks! Don't worry - if your credit score isn't good, they won't count it against you and charge you more.

8. Combine your auto and home insurance

Whether you own a home, condo or rent a place - you need property insurance. Insurance companies give big discounts and free features when you combine your home and auto insurance together.

[ninja_form id=2]

9 Ways to Save Money on Your Home Insurance

As claims keep going up, so do your home insurance premiums. You can read all about it in our blog post. But is there anything you can do to keep your premiums as low as possible?

Fear not! Here's 9 ways you can save money on your property insurance premiums:

1 - Get a monitored alarm

Professionally monitored alarms are a great way to reduce the risk of theft, fire or water damage. Companies like Sentry and Vivent have alarm systems that can monitor for low temperature, forced entry, fire or water leaks. Insurance companies give the best discount when you have water sensors.

2 - Need a new hot water tank? Go tankless

Hot water tanks normally need to be replaced every 10 years or so. If you’re due for a new tank, think about getting a tankless system. Rather than have a big 40-gallon tube of hot water in your basement, you have a box that goes on the wall. It generates how water on demand, which means the risk of the tank bursting is gone. They’re more expensive, for sure – but a tankless system can save you around $200 a year on your home premium!

3 - Need a new roof? Get Class 4 shingles

If you have an asphalt shingle roof, you need to replace it every 15-20 years. Asphalt shingles are now rated from Class 1 to Class 4. Class 4 shingles are considered hail-resistant and insurance companies give you a nice discount when you have them. If you need a new roof, ask the roofing company for a price on Class 4 hail-resistant shingles.

4 - Doing basement renovations? Get a backwater valve installed

In Edmonton, homes built since the early 1990’s have a backwater valve. It helps prevent a sewer back up during a heavy rainstorm or Spring melting. If your home was built before 1990, chances are it doesn’t have this simple device. If you are doing basement renovations, you’ll have to knock out some concrete to get at the pipe and have one installed. When you do, let your insurance broker know!

5 - Install a Water Flow Device

Intact Insurance now offers a discount when you have a water flow device installed. What’s a water flow device, you ask? It’s a gadget that’s installed on your home’s main water line after the water meter. It monitors a plumping pipes, fittings and appliances for abnormal water flow. If anything is detected, the water is turned off automatically.

6 - Increase your deductible

If you’ve been with the same insurance company for a long time, you still might have a low deductible of $500. A deductible is the amount you pay when there’s a claim. When it comes to home insurance, you want to avoid putting in small claims. Ask your broker to quote your policy with a $1,000 deductible. It will save you money!

7 - Credit consent

Insurance companies now take your credit score into account when quoting. Make sure you give your broker consent to let the insurance company pull your credit history – it can save you a few hundred dollars on your premium! If your credit is good, you will save money. If it isn’t, they won’t count it against you and charge you more.

8 - Avoid small claims

If you have 2 or more claims in 5 years, insurance companies start to really raise your premiums. If we get a bad hailstorm or sewer back up, there’s not much you can do about it – you will have to make a claim. But, if you have some small wind damage and the cost isn’t too high, consider paying for the repairs yourself.

I’ve seen people put in small claims and then something really big happened. Their premiums went up a lot. In some cases, the insurance company declined to renew their coverage! When it comes to claims, pick your battles and get advice from your insurance broker.

9 - Combine your home and auto insurance

If you have auto insurance, you can save a good chunk of money when you combine your home insurance. If there’s ever a claim on both, sometimes you’ll only need to pay 1 deductible. Some companies will even throw in great freebies like free Accident Forgiveness!

[ninja_form id=5]

Why do my insurance rates keep going up?

The old joke goes, “there are two things you can count on: death and taxes”. It seems that rising insurance premiums can be included. Why is that? And is there anything you can do about it?

There's 2 main reasons why premiums go up:

- The rising cost of claims

- Low interest rates

Where does the money go?

When you pay your premiums, where does it all go? Does the insurance company gouge you and keep it all to themselves?

For every $100 you pay in premiums, insurance companies keep about $8. That 8 bucks is the company’s profit margin.

According to the Insurance Bureau of Canada's annual report, $56 of every $100 you pay goes to claims. Another $35 goes to taxes and expenses:

Are expenses too high?

You might think, "Wow - 21% for expenses? That seems really high!"

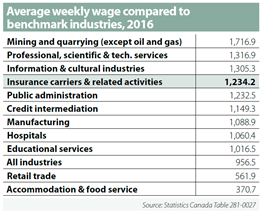

The insurance industry employs a lot of people and wages make up a big part of that expense. The insurance industry pays about the same as the government sector:

Source: IBC Annual Report 2017

For the most part, workers in the insurance industry are not getting paid like royalty or professional sports players.

Auto Claims: More of them - and more costly

In 2015, there were 384,656 auto claims in Canada – one every 82 seconds. By the time you finish reading this post, there were 5 car accidents!

In that year, the average claim cost $10,043 and the average premium was $987. From 2011 to 2015, Liability claims increased 11.2%. As a result, Liability premiums increased 14.4%.

Auto insurance premiums are highly regulated by the government, and insurance companies must apply for rate increases. In 2012, an Alberta court decision weakened the minor injury, or “soft tissue” payment cap. When that happened, the cost to settle bodily injury claims rose 51%!

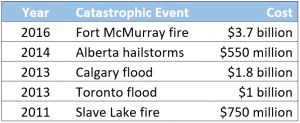

Catastrophic Claims

Insurance companies pay out a lot of small claims for fender-benders, kitchen fires and sewers backing up. It’s very hard to account for rare and catastrophic claims. Recent ones include:

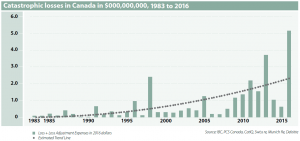

This chart shows the trend of catastrophic losses in Canada - and its not a good one:

Because they are rare and nearly impossible to predict, insurance companies can't plan for large catastrophic claims. When they happen, companies need to raise premiums to recover losses.

Interest rates play a big factor

Insurance companies take your premium and save a chunk of it for future claims. This is called a reserve. Almost 70% of insurance companies invest those reserves in bonds. As interest rates fall, so does the profit on those reserves.

Throughout the 1980’s and 1990’s interest rates fell a lot. As those high-yielding bonds matured, insurance companies had to re-invest at low rates. Think of this way: insurance companies count on making money on the reserves so they can pay out claims. If profits on those reserves fall, then they need to get more premiums!

Can you self-insure?

You’ve seen your insurance premiums rise every year and maybe you’ve never had a claim. You might think to yourself, “Why bother paying for insurance I’ve never used? I should insure myself!”

In Alberta, you must carry Liability insurance on your vehicle. Other than that, you are not legally required to have insurance on anything. If you have a mortgage on your home, the lender will probably ask you to have insurance – it’s their money in your home, after all.

Large companies will often self-insure parts of their business or equipment. They have deep pockets and can afford a loss. If you have deep pockets too, then self-insuring part of your stuff is an option.

What can you do about it?

To some degree, rising insurance premiums have become a part of our life. The idea behind insurance is that we all share in the risk with small losses that are known – the premium. We protect ourselves against the large losses we cannot pay for ourselves.

However, there's lots of things you can do to lower your premiums or keep them low! Check out our blog post on 9 ways to save money on home insurance and 9 ways to save money on your car insurance

Moving to Alberta? Here's the best way to save a bundle on car insurance

If you are new to Alberta and you were driving in your home province, state or country - learn how to get the lowest rate available.

Driving History and Insurance History

In Alberta, insurance companies set your rate based on a few things:

- When you were first licensed

- Convictions in the last 3 years

- Suspensions in the last 6 years

- Claims in the last 8-10 years

When you are first licensed and insured in Alberta, we get this information from 2 places:

- Your driver's abstract, also referred to as a Motor Vehicle Report (MVR)

- Your insurance history, which is kept by Autoplus. You can check out Autoplus here

Why Does This Matter?

Maybe you've been driving for years before moving to Alberta with a clean record - no claims or speeding tickets. You're a good driver: so why is the insurance company quoting you such a high premium?

They just can't take your word for it - they need some documentation. They need proof.

If you have 9 years of clean driving, you'll pay a much lower rate than if you have 2 years. Calling the "cheapest" company won't help if they don't give you any credit for those 9 years. The difference between 9 years and 2 years can be over $1,000 a year!

Getting a copy of your driver's abstract and claims experience letter might seem like a hassle, but it could save you a bundle.

Your Driver's Abstract and Claims Experience Letter

Insurance companies need 2 things from you:

- Your driver's abstract, also referred to as a Motor Vehicle Report (MVR). It's issued by the province, state or licensing authority. It lists when you were first licensed and if you've had any convictions or suspensions. Most licensing authorities have a website and the order form. Below you'll see the links to some of them. You'll need to know your driver's license number and they'll ask you some personal information. Expect to pay about $15 to get a copy.

- A claims experience letter from the insurance company. It needs to be on company letterhead and will show when you were added and removed from the policy. It should list all claims and whether you were at-fault or not at-fault.

To get a copy of your claims experience letter, the insurance company needs your policy number. Keep that number! You should always keep a copy of old insurance policies with the number. They won't charge you a fee for this report.

If you've had insurance from a few companies, you'll need letters from all of them. We need to figure out if you've had continuous insurance history - or if you've had a gap.

Not All Insurance Companies are the Same

- All companies will take history from the Canadian provinces

- Most will take history from the United States

- A few will take history from all other countries

If you're moving to Alberta from outside Canada or the US, get a quote from a company that recognizes your history. All of the companies we deal with will count it!

Moving from Ontario or the Maritimes

If you're moving to Alberta from these provinces, you're in luck - we do things the same way. Keep your driver's license number. We'll need it to pull your Autoplus report. For your driver's abstract, here are the links:

- Ontario https://www.ontario.ca/page/order-drivers-record

- Nova Scotia https://novascotia.ca/sns/rmv/licence/abstracts.asp

- New Brunswick http://www2.gnb.ca/content/gnb/en/services/services_renderer.200564.Driver_Records.html

- Prince Edward Island http://www.gov.pe.ca/photos/original/tpw_dr_abstract.pdf

- Newfoundland http://www.servicenl.gov.nl.ca/drivers/DriversandVehicles/driverlicensing/abstract.html

You might have to pay $15 or so - but you'll only need to do this once. The abstract will show convictions in the last 3 years and any suspensions.

Moving from British Columbia, Saskatchewan or Manitoba

These 3 provinces manage your license and your insurance. When you request a copy of your abstract, you'll also get claims experience information on that report.

- British Columbia http://www.icbc.com/driver-licensing/getting-licensed/Pages/Your-driving-record.aspx

- Saskatchewan https://www.sgi.sk.ca/abstract-details

- Manitoba https://www.mpi.mb.ca/en/DL/DL/Records/Pages/drv-records.aspx

Moving from Quebec

Although Quebec works the same way as Alberta, we can't access Quebec Autoplus reports. You'll need to request your abstract from SAAQ and your claims experience letter from your insurance company.

Moving from the United States

If you're moving to Alberta from the US, it works basically the same. You'll request your abstract your state DMV (Department of Motor Vehicles) or the DPS (Department of Public Safety). You'll also need a claims experience letter from your insurance company. Here are a few links:

- Texas https://www.dps.texas.gov/DriverLicense/driverrecords.htm

- Colorado https://www.colorado.gov/pacific/dmv/purchase-motor-vehicle-record-mvr-letter-clearance

- California https://www.dmv.ca.gov/portal/dmv/detail/online/dr

- Virginia https://www.dmv.virginia.gov/general/#records/drive_record.asp

If you google your state with 'drivers abstract', you should be able to find out where to request the report.

For your claims experience letter, you'll need to know what insurance company (or companies) you had and your policy number. Make sure to keep that information!

Moving from All Other Countries

Before you get to Canada, get a copy of your driver's abstract from your local licensing authority. It will need to be in English, or you can have it translated into English.

You'll also need a claims experience letter from the insurance company. Don't forget - it needs to be on company letterhead!

Here are a few countries that have driver abstracts:

- United Kingdom https://www.gov.uk/view-driving-licence

- Australia - New South Wales https://www.service.nsw.gov.au/transaction/request-driving-record

- Hong Kong https://www.police.gov.hk/ppp_en/05_traffic_matters/tcr.html

- Germany https://www.kba.de/EN/ZentraleRegister_en/FAER_en/Auskunft_en/faer_auskunft_node_en.html

How Far Back Do You Need to Go?

Some insurance companies look at the past 6, 8 or even 9 years. You don't need history from 1985, but back to 2007 is enough to get the best rate possible.

In Alberta, we also use something called the grid. We use your abstract and claims experience to figure out your grid rating and the best is -15. This can be very important if you have an accident later on and it was your fault.

A little work can save you a lot of money

In my experience as an insurance broker, I get calls from people who have been driving for years in another province or country, but they are paying way too much. This wasn't explained to them, or they didn't know that it could make such a big difference.

It is a bit of work, but to save $1,000 a year on your insurance for the next 6 years really adds up!

Heading South? Don’t Get Burned by Your Travel Insurance

If you are travelling out of Canada, travel insurance is a very good idea. But all travel insurance policies are created equal, right? Not always. Here’s the basics of what you need to know when you pack your bags and head out in the world.

Coverage

Our preferred carrier covers up to $5 million for emergency medical expenses. That also includes ambulance, a hospital stay and emergency air transportation back to Canada. All travel plans cover injuries and illness that are sudden and unforeseen. If you leave home with a broken leg, you won’t get your cast changed. If you break your leg in the Grand Canyon, you’re covered.

Deductible

You can get a $0 deductible, all the way up to a $100,000 deductible. Most people choose a $300, $500 or $1,000 deductible. As with any insurance policy, the higher the deductible – the lower the premium.

Doesn't My Credit Card Cover Me?

When you pay for a trip on your credit card, the credit card provider may include some travel insurance coverage. Make sure you understand what they do – and do not – cover.

For example, one travel credit card policy I looked at requires you to call Assured Assistance before you receive treatment. If you call after receive treatment, you will have to pay a portion of the care up to a maximum of $25,000. That same credit card only covers you for the first 15 days if you are under 65, or 3 days if you are over 65. If you plan on being gone longer, you need to call your credit card company to buy additional coverage.

Coverage is only for the credit card holder – your spouse or family member may not be included! Your credit card won’t cover you for uncertified scuba diving, skydiving, or anything considered an ‘Adventure’ or ‘Extreme’ sport.

What About My Group Insurance at Work?

Most employer-sponsored group insurance plans that include health coverage with include some travel coverage. One plan I looked at covered up to $5 million of emergency medical expenses with a 15-day limit. Your group plan may offer up to 30 days of emergency medical travel. If you are going to Vegas for 4 days, this could be fine. If you are going to Europe for 2 months, you’ll need to buy additional coverage from your broker.

Adventure and Extreme Sports

Some travel policies exclude coverage for activities like:

- Backcountry skiing

- Mountain biking

- Endurance activities over 6 hours (like an IronMan in Hawaii)

- Skydiving

- Scuba Diving over 30 meters

- Running with the Bulls

When you get a quote from your insurance broker, let them know if you will do anything more than lay on the beach or hit the casino. For a small amount, you can get coverage for all of the activities listed above – and more!

Is Trip Cancellation Worth It?

The maximum benefit for Trip Cancellation is $25,000, which is probably more than you are spending! The cost is much lower than a heart attack in Florida, but the chances of a trip being cancelled are much higher. For that reason, Trip Cancellation costs more than the Emergency Medical policy. If you are concerned about a trip being cancelled, this coverage can give you peace of mind.

Trip Interruption

This feature covers you if a trip is ended early due to an illness, death of a travel companion, travel advisory or natural disaster. The cost of an interruption is cheaper and less likely than a cancellation – and the premium is a lot less than Trip Cancellation.

What About Baggage?

Your homeowner’s policy covers your belongings anywhere in the world, including a vacation. However, if you get your luggage stolen in Wisconsin, it is a claim against your homeowner’s policy. You can buy coverage for up to $1,500 of your stuff.

Renting a Car on Your Trip?

For a small premium, you can get an Extension to Non-Owned Vehicles added to your auto insurance policy. You need to have insurance on the vehicle, which is normally Collision and Comprehensive. This coverage is good anywhere in Canada and the US. If you rent a car in Palm Springs, you are covered. If you rent a car in Mexico, you are not.

If you rent a car outside of Canada and the US, you can purchase Collision coverage here in Canada. Typically, we hear that the premiums are much lower than what the car rental agency charges. However, you will still have to get Liability insurance from the rental agency.

As a service to our clients, we can give them a Confirmation of Coverage letter when they rent a car. Those letters are good to the end of the policy term and can come in handy if the rental agency wants proof of insurance!

Are you a Commercial or Residential Condominium Unit owner?

THEN YOU SHOULD ENSURE YOU HAVE ADEQUATE LOSS ASSESSMENT COVERAGE.

Most Condo Unit Owners will purchase a Condo Policy for protection to the inside of their unit (Betterments & Improvements), and perhaps for incidents outside of their personal unit. However, sometimes these claims may exceed the policy limits and the condo unit owners may be asked to make up the difference out of their own pocket. The Condo Loss Assessment coverage can help to avoid making those out of pocket payments when a common area needs the assistance from the unit owners.

Example:

Condo building suffers lightning damage estimated at $550,000. Master policy only covers a limit of $500,000.

The extra $50,000 would be divided among the 40 unit owners (for example).

Each unit owner would then have to pay $1,250 to make up for the difference.

Contact us if you would like us to audit your current policy or provide terms for a future policy.

Presenting Anderson Career Training Institute and their Self Employment Program

Presenting Anderson Career Training Institute and their Self Employment Program

The Anderson Career Training Institute -ACTI- with the Goverment of Alberta's ministry of Labour chose us to host the press release to bring awareness to the ACTI and their Self Employment Program.

We are proud of showcasing these tools that were instrumental in our growth as a company, and enabled us to contribute to our community by providing top service and education to our clients.

The Minister of Labour, Christina Gray and the Minister of Economic Development and Trade, Deron Bilous; will be here and will support the presentation of the program and how it contributes to the economy in general.

They trusted us and we are more than grateful. That is why, we want to share this news with you, and take the opportunity to thank you again for placing your trust in Caliber Insurance Brokers.

“Graduating from this program through ACTI provided me with the confidence and crucial tools needed to successfully start my own business. I am now a proud owner of a local business that provides employment to other insurance professionals.”

- Evelinne Teichgraber. President Caliber Insurance Brokers

We are here to give Alberta's families peace of mind with respect to their insurance portfolio.

* We serve you in English & Spanish *